Cash is something every business needs and wants, but is unlikely it will flow to the degree we want it every week. Therefore, the ability to “predict cash” (which sounds lofty–like one of the four pillars of business philosophy) is an essential art and science for most business owners and it doesn’t have to be that hard once you apply some intentional effort.

If cash is tight, you need to plan for payroll and large expenses or inventory purchases. If you have plenty, you need maximize your capital and debt efficiency. So being able to predict cash is an invaluable skill. Here are some tricks to help you get better at it.

Six Tricks to Improve Your Ability to Predict Cash

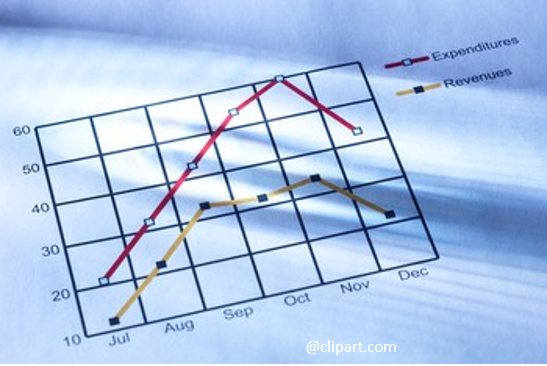

- Track actual history. Accurate actual data is essential. Trend lines and history help predict the future.

- Know your payroll and payroll related costs to the penny. These are the biggest costs in most business and are generally easy to predict.

- Know your customers’ payments history. 80/20 your customers and know their payment cycles to help forecast accounts receivable turnover.

- Know your expenses. Nothing hurts more than getting a surprise invoice you should have known about. Again, good history helps. Some invoices are predictable–or should be. If you relate with a particular vendor regularly, you should be expecting to get bills from them!

- Compare actual to plan every week. This will help you improve your forecasting.

- Get others involved. Have the people responsible for accounts receivable help predict cash receipts; have HR give the weekly payroll costs; have accounts payable and purchasing predict weekly cash disbursements. We can’t work in a vacuum. All of us together are smarter than any one of us alone.

Put these tricks into practice and see how your information and expectations improve.

Need further help? Contact me!