Winter is finally over here in the northeast. The ice is off the lake. Spring is here.

And March Madness is over. There were some close games, even to the end. Can you imagine what this tournament would be like if they didn’t keep score?

It’s hard (and no fun) to play a game without knowing the score. What’s the point of playing a game without keeping the score? (Yes, I realize we should do some things for the joy of the game, but there’s a reason there aren’t too many “non-scoring” leagues.)

It’s the same in our businesses and professional careers. I love asking business people, “How often do you perform your quarterly business reviews?” That’s your form of score keeping.

It’s not fair to ourselves just meander through the year and see where we end up. We set goals and make plans. We visualize results. We measure against the results and reset goals and plans to improve performance.

I used to set annual goals, but now I set quarterly goals. The shorter window helps me keep intensity and focus. So now I remind you: it’s the end of the first quarter and time to review your scoreboard. Ask yourself:

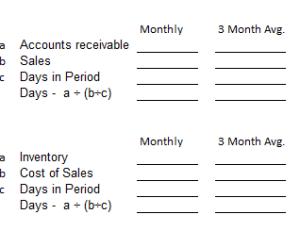

- As a business owner, manager and visionary, what are your numbers? For me, the score is generally the sales numbers, gross profit growth, segment profitability, EBITA (earnings before interest, tax, depreciation and amortization) growth, average revenue per invoice per customer, number of new customers, and developing scalability or stability, plus some other measures.

- As a team leader, does your team understand the scoreboard? What will you do to help them push to maximize the score?

- As a self-manager, what does your personal scorecard look like? Are you improving yourself and your life?

After you answer these questions and tally the numbers, you will find areas of improvement. The good news is, in most every business, there’s only a few things that you have to narrow your focus on to make solid headway. Find those vital objectives and leading indicators–your scoreboard should give you clues. We sometimes focus too much on the lagging indicators throughout the year–most of the time we should focus on the leading indicators and make them even better. Yes, give some attention to the areas that lag, but strengthen your strengths. You may find that eventually, the areas that lag may not need to be part of your long-term strategy anymore.

Now, do a solid financial close and look at the numbers – then set some goals for the next quarter.

I just looked at some of my goals I set in December. The scoreboard pointed out some wins, and some losses, some good results, some bad results, and some non-existent results (to be honest.) Not bad, but not exactly where I hoped to be on some levels. I’m glad the first quarter is ending, and for me the score is fairly even, which gives me a decent base to shoot for more wins by the end of the next quarter.

I can help you do the same. Contact me.