Well, happy spring! I hope you had a successful first quarter.

Now that Q1 is over – how did you make out with your first quarter goals? For me, the year-end CPA audits are done, my “big rock” goals were completed, and my teams are ready to jump into the second quarter. It feels good to finish strong, and I hope you did too.

If you didn’t finish as strong as you hoped, I urge you to get your first-quarter financial results wrapped up early and do a solid comparison to your projections. Take another look at your 1-year plan to ensure that you are on target.

Also, set up a meeting with your banker to ensure they are up-to-date with your financials. A strong relationship with your bank can be so important in good and bad times. Banks don’t like surprises and will appreciate you being proactive. Review your year-end financials, first-quarter numbers, and forecast for the future so they can have a clear view and be confident that you know what you’re doing.

As the second quarter kicks off, it is a great time to evaluate your team. How did they perform over the quarter? Are the right people on the bus and in the right seats? I’m currently going through an exercise with one of my clients to evaluate the finance team. We are reviewing the org chart based only on accountabilities, not names. We will be making some adjustments. We are starting with what needs to be done, then ensuring we have the right people in the right spots.

As I look back, Verbeck Associates and my clients had some huge goals for Q1 that seemed unreachable at the time … and yet … we nailed them. We held each other accountable, reviewing the ‘Weekly Big 3’ weekly, and if someone is behind, we help them with resources and reprioritize priorities so we hit the targets. That process was the key to our reaching those ambitious Q1 goals.

Let’s check on your progress:

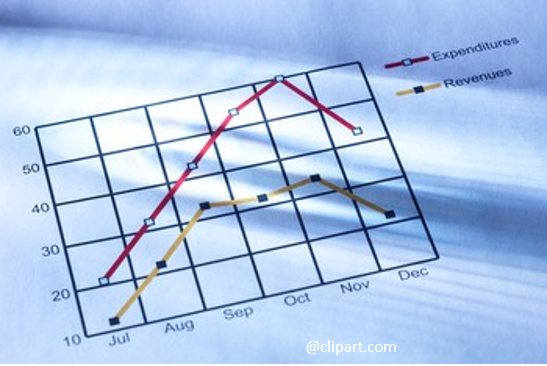

Compare your Q1 financial results to your Q1 budget and to Q1 last year. Look at sales and gross margin by segment, overhead and payroll expenses, and cash flow. How did the quarter stack up compared to your plan and to last year?

If you’re behind on your goals – be honest – face it head-on and up your discipline. Don’t use the excuse you didn’t have enough time. There’s never enough time. You need to make time and keep your focus on the important things.

Now, set up your next 90 days. Set your “big rock” goals in place and get to it!