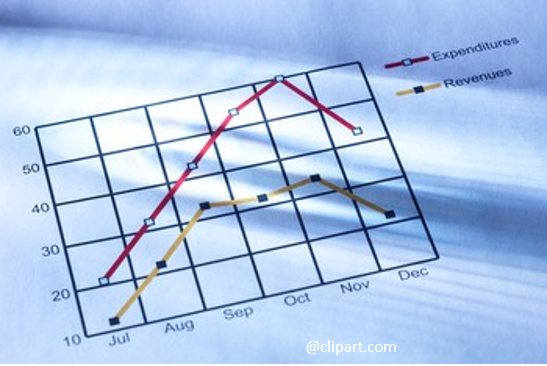

As a business owner, you need to be able to predict the future.

Verbeck Associates has been doing a lot of business modeling lately. It must be the time of the year and the type of clients I’m working with now. I am currently working with two turnaround companies and four startups – both require financial modeling for forecasting results and developing successful strategies to deal with tight cash flow.

We use business modeling to:

- Develop internal goals and targets – and provide a budget and scorecard.

- Determine feasibility and what-if scenarios to test growth and survival strategies.

- Pitch new financing or new equity capital to show cash investment needs.

- Evaluate capital investments and strategies.

- Produce forward-looking financial statements for your bank and existing lenders.

Keep in mind: projections are wrong by definition. They are future-state, and no one has a crystal ball.

We can certainly get in the weeds with modeling – I run that risk all the time. That’s why I aim to keep it simple. The more complex, the more confusing and subject to error. My models are generally simple 24-month forward-looking financial statements. Here’s how to take a simpler approach to reduce the number of inputs and reduce potential errors.

Take a higher 30,000-foot view first thinking more strategically in both the short-term and down the road. For example, “Based on this revenue, we require this headcount and should be able to deliver x net income and cash flow.” What would happen if we do this or if we do that? This then develops into a more granular approach with a 24-month working model.

It’s interesting to observe the thought process of many business owners. Most understand the income statement, but many have trouble with the balance sheet and the statement of cash flow. All business models start with the income statement so it is important that we understand the revenue model, the go-to-market and sales plan. But that’s not enough. Owners need to understand product costing, product mix, margins by segment, customer acquisition costs, etc.

When I review all this with owners, I start with historical financials numbers for the last 24 months: revenue, margins, headcount, operating expense growth, accounts receivable and inventory turnover, accounts payable days, debt repayment schedules. For startups, historical information is non-existent which can make this more challenging! We work with whatever information we have, and/or consider the following elements and questions:

Plan: The essence of a model starts with the sales plan. What are the expected monthly sales by customer and by segment for this coming 12+ months? Consider the basic business model of:

Leads x conversion = customers x number of transaction x average selling price = revenue. See more discussion in an earlier article

Process:

Develop a realistic sales plan by customer and by product segment. Understand units sold per month and sales potential growth.

Develop a detailed personnel plan (see template). People are generally your largest cost and your biggest asset.

Based on the sales plan, understand the timing of raw material purchases. This obviously depends on your business. For one of my current clients who purchase a product from China, significant lead times must be considered.

Document all assumptions. What is true and what you predict will happen. Prepare a summary of significant assumptions document to attached to final projection printout. The document walks through the income statement sections discussing the thought process with units shipped, sales growth, cost of sales, gross margin by product segment, selling costs, customer acquisition, personnel costs, operating expenses, interest, and depreciation – each line of the income statement. Do the same with the balance sheet – documenting the turnover and asset velocity assumptions, cash and debt needs. (The forecast model and assumptions support the 13-Week Cash Flow process if your company is tight on cash. More on that later.)

It’s essential that the assumptions are reasonable, supportable, and documented. And updated.

I like to go through this plan/process in three ways, producing a conservative, moderate and aggressive model. This helps a business owner make wise decisions, and the more historical data that surfaces as time goes on, the more accurate the modeling can become. But you have to start somewhere — because you probably don’t have a crystal ball (at least not one that works.)

Image by Alexas_Fotos on Pixabay