In many sports games, especially for the team currently losing, the second half (or some other division such as inning or quarter) feels like a fresh start in the middle of the overall fight to win. We are at that point in the year where we can take a look at the start of the “second half.”

So, how has the second half started for you and your business?

Hopefully, you’ve been having a great summer and took some time for ‘half-time’ to consider how you and your business performed in the first half.

Half-time is over now, and the second half is starting to move fast. If you haven’t already done so, spend some time this week to get solid performance data and start developing a revised second half-year business plan. Get your Q2 Team Meeting on the calendar for August!

I’ve been spending time with my clients doing much of the same. We’ve been wrapping up the quarter and the first half year, getting cash flow and business drivers’ actual results, updating the 13-week cash flow forecasts, and setting up meetings to talk with their lenders and shareholders about the results and targets.

We always need to be looking at the instrument panel and make adjustments as we go.

For one of my newer clients, we measured accounts receivable and inventory days and graphed the last 18 months. We noticed some turnover creep and developed strategies and goals to improve that issue.

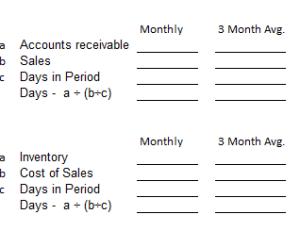

Let me give you some help for calculating your own turnover days. Here’s a simple worksheet.

I generally use the three-month average for my calculations. The calculations show how many days, based on history, that it takes for accounts receivable or inventory to turn into cash.

The powerful thing is the cash generated by reducing the days. Say your company does $5,000,000 in annual revenue and has consistent sales approximately of $400,000 per month with 32% gross margins. Your accounts receivable has averaged 42 days and inventory has averaged 52 days for the last year. If you develop strategies and measures to bring down the Receivable and Inventory turnover days each by 4 days, you will put $90,000 of cash on your balance sheet. Imagine a 10 day improvement and if you’re a $10mm business with the same improvements as in the example above, that’s $180,000 increase in cash!

Now that we only have four months of the year left, it’s also time to refocus on the year’s intentional goals and continue pushing and developing tactics to hit those targets.

Ensure your June’s financials are closed, and you have good business performance data (Sales and gross profit by segment, by customer, by sales rep, etc.) Ensure all projects are focused and moving forward–if they’re behind schedule, you need to set new targets or get them back on track. Things have changed since you developed your initial plan. Make the changes in your projections, and develop your second half business plan.

A good part of running a business is regular evaluation of where things stand, and where/when it’s time to make adjustments. The calendar provides regular markers for activities like these, but it’s up to YOU to take the time to consider and implement what steps you need to take!